Banking Conversion 101: Chapter 1

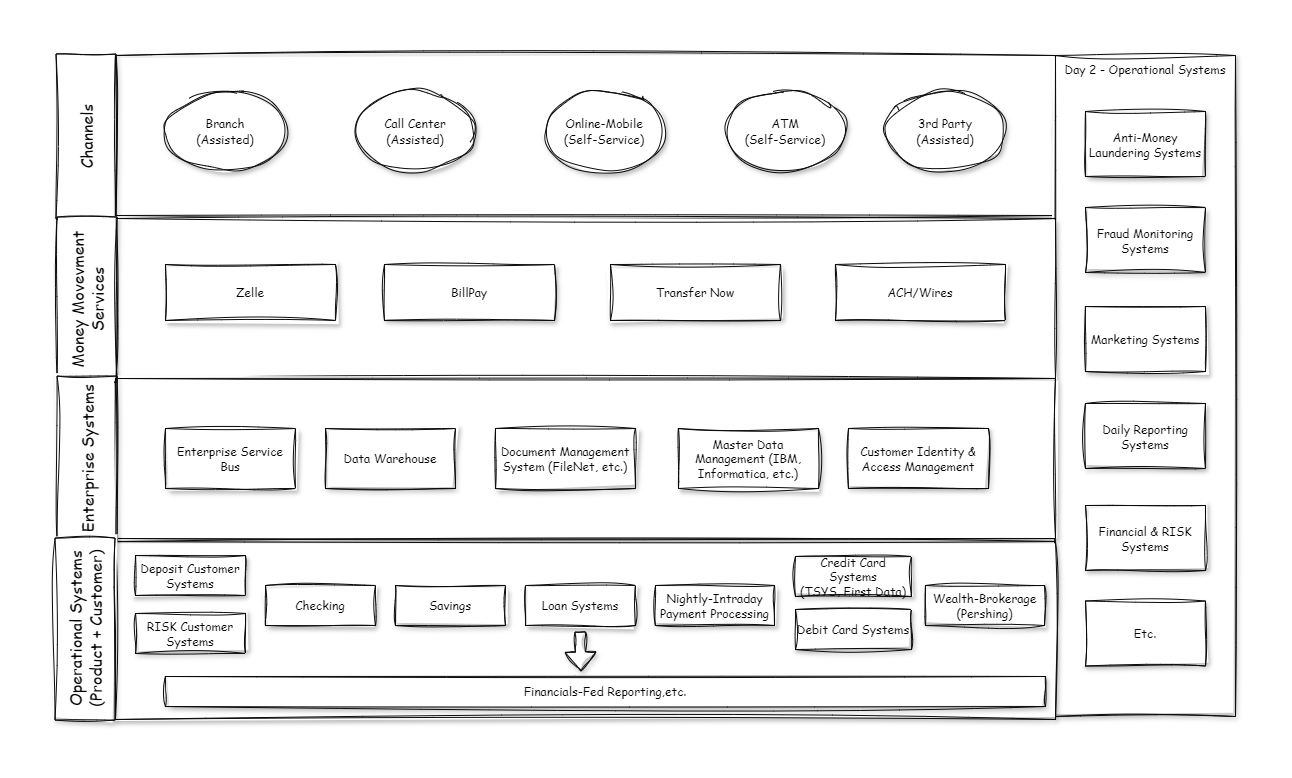

The Situation: You are in charge of a large banking conversion as part of Mergers & Acquisition Activity….You own the Architecture and overall delivery…..What kind of systems are we dealing with…

What is the assignment: You will learn how to build a strategy, understand architectural pitfalls (anti-patterns), and understand financial services (nuances of vendors).

Total Time: 83 hrs

Lines of Business: 4 (Retail Banking (Deposits & Loans), Commercial Banking, Wealth(Retail), Capital Markets)

Conversion or Lift & Shift: Full conversion from the acquired firm to the purchaser.

Early Conversion: Potentially for some of the vendors due to the difficulty of aligning all vendors and systems at one time. The number of anti-patterns in your environment can make these events more difficult.

Pre-staging: An option if your systems are not performant in their ETL processes.

LoB Linkages: Line of Business are interlinked due to the different services each provide to the other.

Firsts steps

Below is common description of systems and some characteristics that require a delineation of the thought process. A better understanding will be laid as we construct the strategy.

Product Systems - These represent financial product systems that contain/assign the account number, collateral, balance (available funds or outstanding loan). Mixture of Lending and Deposits systems. The types of product systems include:

Network based Product Systems - Primarily categorized as having high degree of connectivity to consumer activity in real-time or near real-time. Examples include TSYS or First Data Credit Card systems that are connected to the VISA and MasterCard Payments network. Other systems include Wealth-Brokerage systems. They maintain-issue the account number and is the system of record for balance.

Aggregate Loan Booking Product Systems - these systems maintain all of the different the loan products. This is true from a commercial and retail lending systems. They maintain the loan balance, collateral and schedules (e.g. payment dates).

Product Systems - these systems are in-house maintained or at FinTech Software providers. The primary characteristic of this systems is that only one operational system exist with a single copy of the data.

Customer Systems

Aggregate Customer-Account Systems - that allow Channel systems (online banking systems) to create a single customer view and also create a mechanism to legal and technology entitlements (i.e., Power of Attorney, Beneficial Owner, etc.)

Master Data Management - create a single customer view - useful for an operational regulatory use for privacy settings, anti-money laundering (AML) and a system to extend customer attributes as new regulatory requirements are issued.

Risk-Customer Account Systems for helping identify customers and their relationships with other customers and total connected risk that they have with the financial institution. These systems can be dedicated system or a combination of systems. Used primarily in Commercial Banking.

Data Warehousing Systems - Used for reporting and transformations of data for day 2 process or intraday processes

Channel Systems - Where customers interact both in self-service or assisted way to execute their transactions.

Money Movement Services - Systems that act as both System of Record that are typically for Money Movement (i.e., Zelle, Bill Pay, etc.)

Enterprise Systems - Primarily built and shared across multiple lines of business. Its typically a data warehouse, identity management, document management systems, etc.

System Data Architecture

This view allows you to understand what data is native to the app and the foreign keys available to the system to look up data from other systems.

| Usage | Systems Types | Key Data - System of Record | System of Reference | |

| Operational Systems - These are system of records for used by Customers. | Aggregate Customer Systems | Customer Attributes (Name, TIN, etc.), Customer to Account Relationships, Entitlements (Legal), Customer Id | Account Number | |

| Frontline Employees and Customers through Channel Apps to check balances, pay balances. | Checking (Deposits) | Account Number, Account Attributes (mailing address), Balance, Available Balance, deposits | ||

| Savings (Deposits) | Account Number, Account Attributes (mailing address), Balance, Available Balance, deposits, Interest | |||

| Loan Booking Systems | Account Number, Product Id, Outstanding Balance Due, Payment Schedules, Collateral | |||

| Nightly Intraday Payment Processing Systems | Transaction Data from External Money Movement ACH Payments, Wires, Debit or Credit,? other transactions. | Account Number | ||

| Credit Card Systems (TSYS, First Data) | Account Number, Balance, Basic Customer Details, Origination, etc. | |||

| Financial - Fed Reporting's | Profitability by Customer Segment, Liquidity, Aggregate Balances, Aggregate Outstanding Due, etc. | Account Numbers, Customer Ids. | ||

| Enterprise Systems - Generic tools and platforms used to create views/context for Channels and Day 2 Operational Systems. | Enterprise Service Bus | N/A | ||

| Data Warehouse (AWS, IBM, Teradata, etc.) | N/A | |||

| Document Management System (FileNet, FIS, etc.) | Document | Account Number | ||

| Identity and Access Management | UserId, Password, login history. | CustomerId | ||

| Master Data Management (IBM, Informatica, Talend, etc.) | Know Your Customer, Privacy Preferences, Enterprise CustomerId | CustomerId , Account Number | ||

| External Money Movement Services | Zelle (Fiserv) | Zelle Proxy Id, Money Movement History, Recipient History, etc. | Deposit Account Number, Customer Email, Customer Mobile Phone | |

| TransferNow (Fiserv) | TransferNow Proxy Id | Deposit Account Number, Customer Email, Customer Mobile Phone | ||

| BillPay (Fiserv) | BillPay Proxy Id, | Deposit Account Number, Customer Email, Customer Mobile Phone | ||

| ACH | N/A | |||

| Channels | Online/Mobile | Payment Schedules, Account Nicknames, CustomerId - Proxy | CustomerId | |

| Call Center | Primarily uses the same software as a branch. There may be IVR to put the customer in session via a screen pop when a Customer provides Account Number, Name or TIN. No Major Migration Impact | |||

| Branch | Employees handle look-ups via key identifiers by the customers: Account Number, Name, TIN, Etc. No Major Migration Impact. | |||

| ATM (FIServ and FIS ATM Networks, etc.) | Customer provide their Debit Card Number and PIN | |||

| 3rd Party Embedded | ||||

Putting it Together

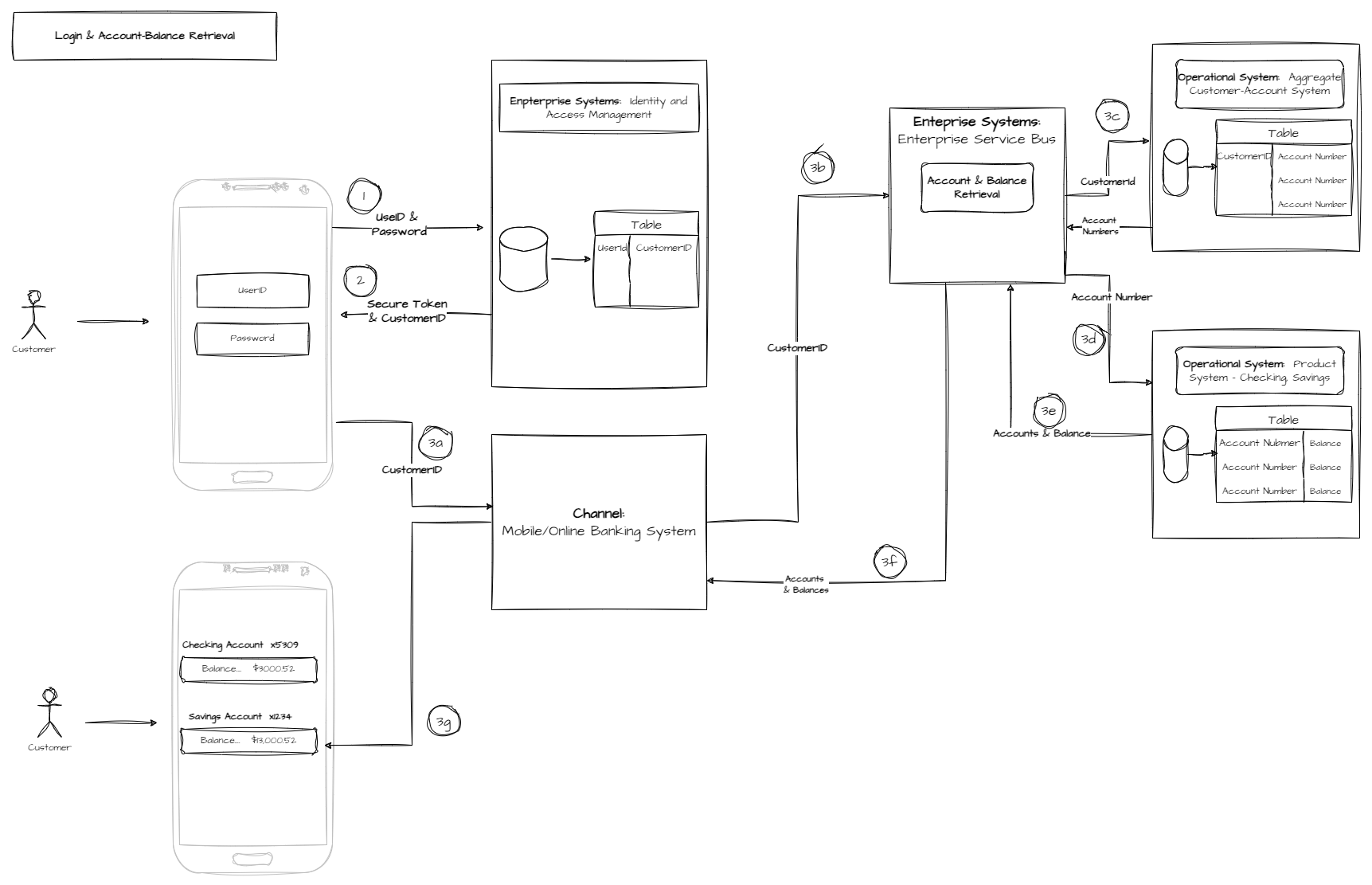

Use Case 1: Getting your List of accounts and balance.

This use case will demonstrate how the data in each of the systems will be input and will provide references to pull the information being requested by the User. The larger idea is to understand how the migrated system of record data as well as the foreign key needs to migrated/updated as a result. In the example below. The UserId needs to be migrated, but the Customer Id needs to be matched from the Aggregate Customer-Account System.

The use case demonstrates the inter-connectedness of the data. In this case, the migration of data should be in the following order:

Core Systems - Migrate the customer into the Aggregrate Customer Systems to generate Customer Ids with a X-Ref file between the old system and the new system Customer Id.

Identity and Access Systems - UserIds with X-ref keys generated in the core systems.

Next Steps: Creating a schedule for the weekend